More million euro homes – based on more million euro debts

Senay Boztas

The number of Dutch homes worth €1 million has grown from just 14,000 to almost 200,000 in the past 10 years, according to property expert Calcasa. Meanwhile, according to figures from the HDN mortgage data network, around one in 200 mortgage applications made in the Netherlands is now at least €1 million.

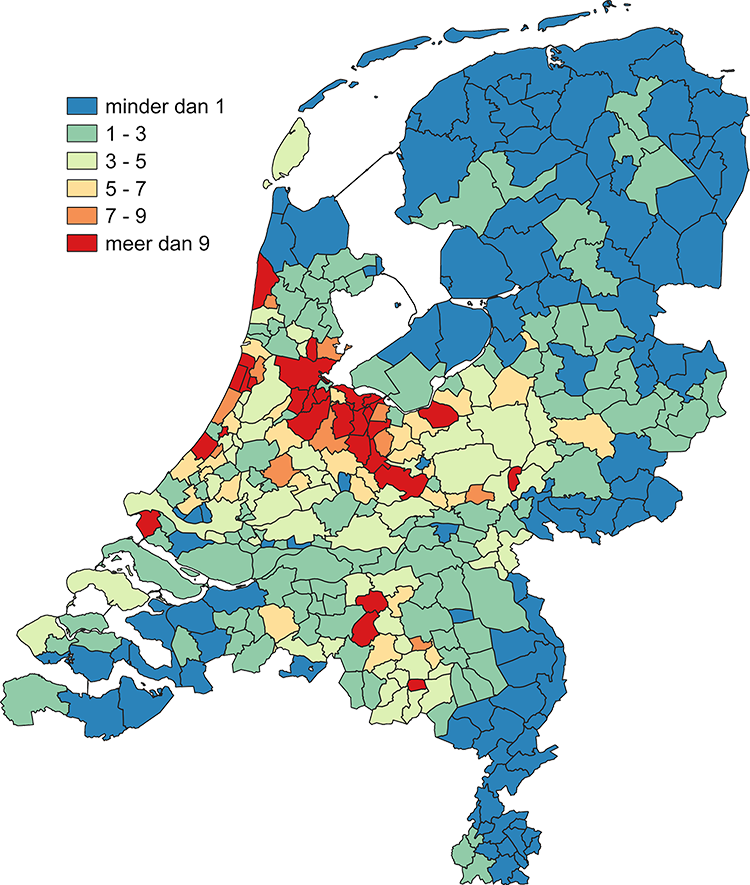

In its annual report, published on Thursday, Calcasa found that by the end of last year 197,000 homes in the Netherlands were valued at more than €1 million, accounting for 4% of the housing stock.

The capital, Amsterdam, has 20,000 homes worth at least €1 million and around half of the most expensive housing stock is in The Hague. However, despite a high in overall average property prices driven by the first-time buyers, there are signs of a slump in value at the top.

Most expensive street

The Netherlands’ richest street, the Konijnenlaan in Wassenaar, was worth 5.5% less at the end of 2023 than the previous year, reports the AD. The average house value – as measured by councils in order to levy local taxes – was €3.1 million, slumping from €3.28 million the previous year. The most expensive neighbourhood in the country, reports the Parool, is the mostly pre-war Diepenbrockbuurt, in Amsterdam-Zuid, where the average property is valued at €2.67 million.

Lennart Rhee, a housing expert at Calcasa, said that they simply measure the figures and the increase in million euro houses, and it is for others to draw their conclusions. “House prices have risen and there are many more million euro houses – that’s a fact,” he said. “It’s difficult to say whether that is good or bad. It’s good if you have a house. It’s not good if you don’t have one yet.”

Figures from the HDN, requested by Dutch News, show several thousand people each year request mortgages of more than €1 million – although 30% of requests in general do not go through. Between 2020 and this year, between 0.46% and 0.73% of all mortgage applications were for at least €1 million, a total of 12,857 requests.

“Overpriced”

Suleyman Aslami, housing spokesman for D66 in Amsterdam, said there was little reason to cheer the new figures on expensive homes. “I think it may feel like good news for the owners, but in reality the increase is driven by speculation,” he told Dutch News.

“The concentration of €1 million homes in Amsterdam shows it is quite a bubble. What I miss in the Calcasa report is a part on the true value of these buildings and the lack of transparency regarding their foundations.”

A report by the RLI infrastructure agency this year suggested up to one in eight houses has a foundations problem, due to climate change and to owners “looking away” for 20 years.

Banks and the AFM have raised the alarm about lending risk on properties liable to flooding and with poor foundations and the Economist last month said climate risks could wipe trillions from global property. “A back-of-the-envelope calculation suggests that roughly 40% of the value of property in Amsterdam could be wiped out by physical risks compared with just 7% for Tokyo,” the magazine said.

Sellers’ market

Calculations from Oxford Economics last year suggested the Netherlands was Europe’s most overpriced house market. According to the IMF, during the pandemic, Dutch house prices grew most in Europe and the country has the highest median level of mortgage debt. Since then, a 6% downturn has reversed and the Netherlands recently achieved its highest-ever average house price.

However, there is a chronic shortage of affordable homes, cited as a huge issue by voters in November and according to a recent analysis by the UN housing rapporteur, caused by policy choices rather than foreigners. The new government wants to build 100,000 houses a year and an affordable housing bill to limit rental costs for “middle” incomes will be voted on by the senate in June.

Rhee said that, despite higher mortgage rates and the failure to price in climate risks, the house rise seems unstoppable. “I think the biggest explanation is the housing shortage in the Netherlands: the demand is still greater than the supply,” he said. “It’s a sellers’ market.”

Thank you for donating to DutchNews.nl.

We could not provide the Dutch News service, and keep it free of charge, without the generous support of our readers. Your donations allow us to report on issues you tell us matter, and provide you with a summary of the most important Dutch news each day.

Make a donation