More Dutch companies are going bust, upward trend continues

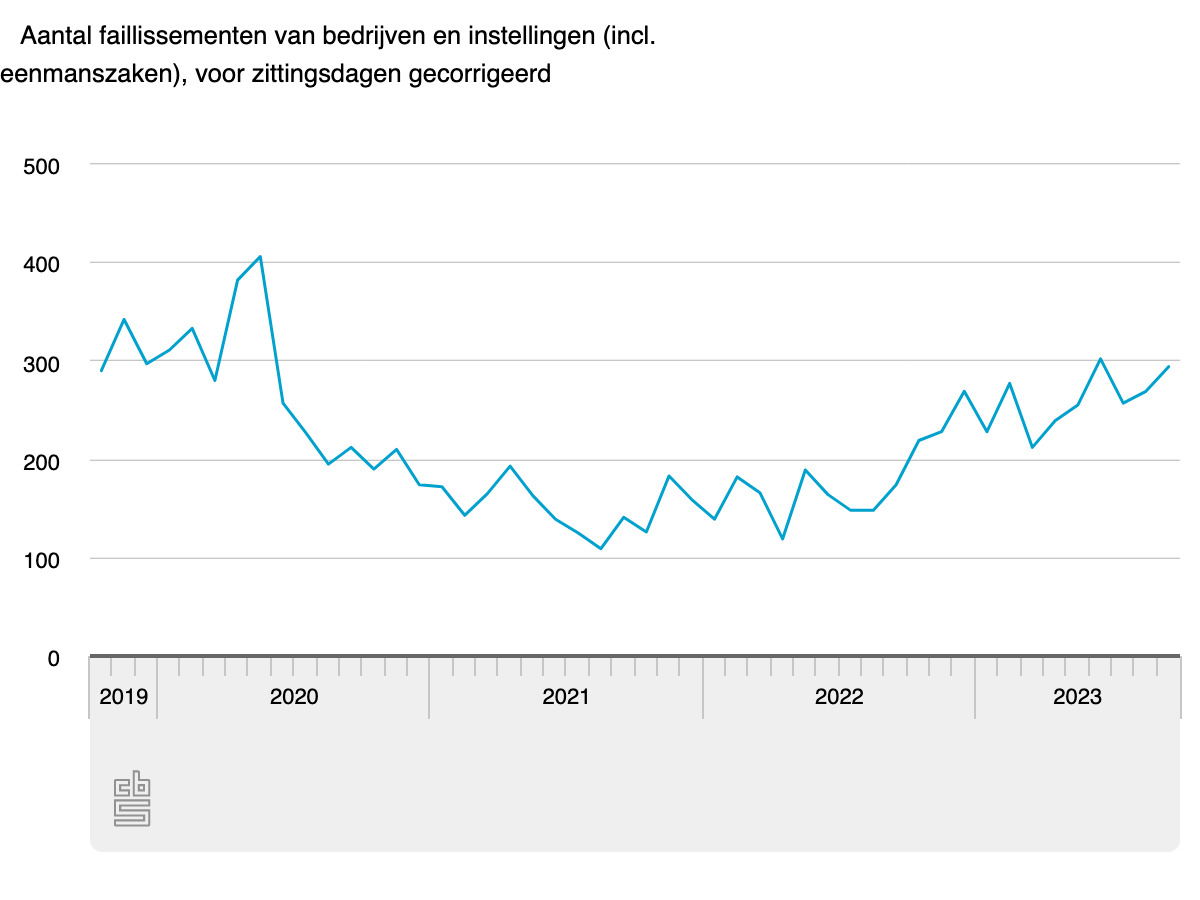

The Dutch bankruptcy rate continues to rise, with 60% more firms going bust in the first nine months of 2023 than in the year-earlier period.

While month on month the increase is still low – just 25 more firms went bankrupt in September than in August – the trend has been upward for over a year, national statistics agency CBS said on Thursday.

In May 2013, at the height of the economic crisis, 911 firms went bust. By August 2021 that had fallen to a record low of 109, as government measures to cushion the impact of the coronavirus lockdowns helped stop companies from going bust.

The central bank said last year it expected the bankruptcy rate to rise once the measures were wound down because some firms which were no longer viable were being kept afloat by the government help. Firms were also able to defer their taxes.

The tax office said in July 37,000 business owners had fallen behind in the installment scheme that gives them five years to pay their deferred tax debt and that 51,000 had not paid anything at all.

Credit insurer Allianz told the Financieele Dagblad in July it expected 3,270 firms would go bust this year, a rise of 52% on 2022.

There have also been a number of high profile bankruptcies recently, including Big Bazar, BCC and the fashion group Doek Retail.

Thank you for donating to DutchNews.nl.

We could not provide the Dutch News service, and keep it free of charge, without the generous support of our readers. Your donations allow us to report on issues you tell us matter, and provide you with a summary of the most important Dutch news each day.

Make a donation