New build for older people could get house market moving: NVM

Not enough housing is being built with the needs of ‘downsizing’ older people in mind, says the NVM estate agents association.

A study of 140,000 house moves by its statistical arm Brainbay found that older people from 60 to 75 tend to move to a home that is €65,000 cheaper, cashing in some of the value for their old age. A fifth also relocated to more than 50 km away, possibly to return to their home region or be nearer family.

But estate agent members surveyed by the NVM said there was not enough suitable new-build housing for the older generation and an ageing population. Councils such as Amsterdam have been writing to older people pointing out that they may have spare rooms and might like to relocate to more ‘suitable’ homes. This ‘moving on’ would, policy makers believe, make space for younger families.

Rieks van den Berk, head of the housing group for the NVM and an estate agent, said it was useful to have insights into the behaviour of older people. ‘We are concerned about the limited attention for this target group in the development of new build,’ he said in a press release.

‘Seniors value self-determination and independence and want a comfortable, age-appropriate home that offers this. We are calling for an increase in provision, so that more people move on and the whole market loosens up. A senior moving frees up a home where a young family can live, and this family frees up a home that becomes available for first-time buyers.’

Price rise

Brainbay analysed thousands of house moves between 2019 and the third quarter of 2022, comparing its member data base with land registry documents to match houses sold and then bought. It based its analysis on the youngest buyer.

The data showed that older buyers were more likely to buy a single-floored apartment in a complex with a lift, with 44% of people over 75 choosing this compared with the tiniest fraction of 25 to 35 year olds. Older people were also far more likely to downsize (85%, compared with just 17% of the youngest group).

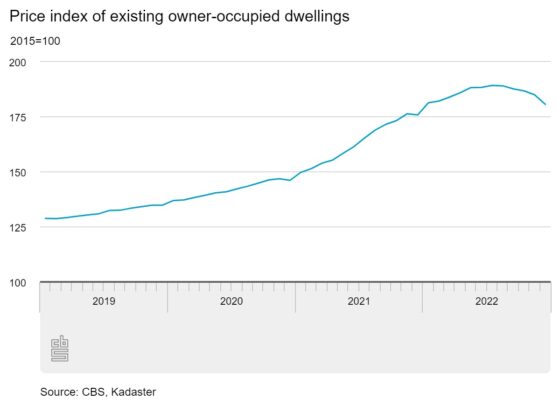

Younger buyers typically bought a more expensive house; then from the age of 55, people tended to buy a cheaper one. Across all ages, in the period, almost half of people sold their house for more than its ‘market’ value based on computer modelling and previous house sales – reflecting the recent price rise in Dutch domestic housing from 2015 to 2022.

Scarcity

According to the Economist, Dutch household debt is typically 2.22 times net disposable income, ranking it one of the world’s most exposed developed countries to the risk of a housing slump (after Canada). The European Union has for years demanded limits on Europe’s most generous tax break on mortgage interest paid.

Alongside very low mortgage interest rates in recent years, allowing greater borrowing, price rises have been driven by a national shortage of housing. Housing minister Hugo de Jonge aims to build 900,000 new homes by 2030.

However the building process is going slower than hoped due to climate change rules, building costs, and house prices that appear to be falling year-on-year, now that mortgage rates have normalised. ABN Amro predicts a 10% house price fall in the coming two years.

Thank you for donating to DutchNews.nl.

We could not provide the Dutch News service, and keep it free of charge, without the generous support of our readers. Your donations allow us to report on issues you tell us matter, and provide you with a summary of the most important Dutch news each day.

Make a donation